Executive summary

Well into our second year of the COVID-19 pandemic, most new drug submissions publicly highlighted during this unprecedented time often focused on COVID-19 treatments and vaccines. As these products have been covered by government funding thus far, there has been no impact to Canadian private payers. However, non-COVID drug submissions to Health Canada during this time continue to be made up of drug products that will put cost pressures on private drug plans. This page highlights some of the notable developments within the Canadian drug pipeline to provide plan sponsors with insight into what’s to come for their members and drug plans.

Drug pipeline at a glance

Migraine

Biologic therapies for migraine prevention were introduced in 2018 and have continued to grow since. However, this year, Quilipta, a new oral formulation targeting the same protein known as calcitonin generelated peptide (CGRP) was recently approved by Health Canada. It is set to compete with the existing four injectable migraine prevention biologics which cost from $6,400 to $30,375 annually.

Weight loss and diabetes

The World Health Organization (WHO) has designated obesity as a chronic disease that is a risk factor for other serious, costly chronic conditions. Diabetes is one of these health conditions and was the top condition by spend on Alberta Blue Cross® private plans in 2021. Drugs coming to the Canadian drug market to treat these two conditions are touted to be more effective than currently available treatments. Wegovy, a once-weekly injection, is set to compete against another medication in the same class, Saxenda. In the diabetic space, a new injectable drug, Mounjaro, is being heavily compared to Ozempic, which has achieved great success amongst diabetic drug therapies.

Cardiovascular

Drug therapies treating cardiovascular conditions have high utilization on any drug plan. A new drug therapy coming to the Canadian drug market treats symptoms of heart failure, aiming to prevent hospital readmission of recently discharged patients. Another notable drug recently approved is the first medication to treat a genetically inherited cardiovascular condition, hypertrophic cardiomyopathy. Existing drug therapies for this condition only treat the symptoms; this is the first to treat the underlying disease.

Plaque psoriasis

Moderate to severe plaque psoriasis can be treated with both biologic therapies and oral therapies. Medications for this health condition continue to expand, seeing an additional biologic as well as an oral medication coming to market to compete with the existing comparator therapies. This space currently has drug therapies with annual costs ranging from $12,250 to $31,300.

Macular degeneration

Coming to the market are treatment options for agerelated macular degeneration (AMD) and diabetic macular edema (DME) that are more convenient in dosing than existing therapies. Current standard of care for AMD and DME are Eylea and Lucentis, both of which are covered by the Government of Alberta if criteria are met.

Rare disease drugs

In the past two decades, research and development for rare disease drugs have grown exponentially. In 2021 alone, there were over 350 rare disease drugs in phase 3 clinical trials; the last phase before submission for drug approval. Historically, once approved, most rare disease drugs proceed to be covered by government funding. However, given the growth in this category and their associated ultra high price tags (some in excess of $1 million annually), government funding may not be reliable or consistent in the future. This will likely result in additional pressure for rare disease drug coverage on private plans.

Generics and biosimilars

While high cost drugs continue to push drug spend up year over year, biosimilar and generic products coming to market help temper this growth in drug spend. Coming to the market soon are biosimilars and generic products for drug molecules that have significant impact on most drug plans. This includes biosimilars and generic products used in treatment of inflammatory conditions, diabetes and attentiondeficit hyperactivity disorder (ADHD).

Background

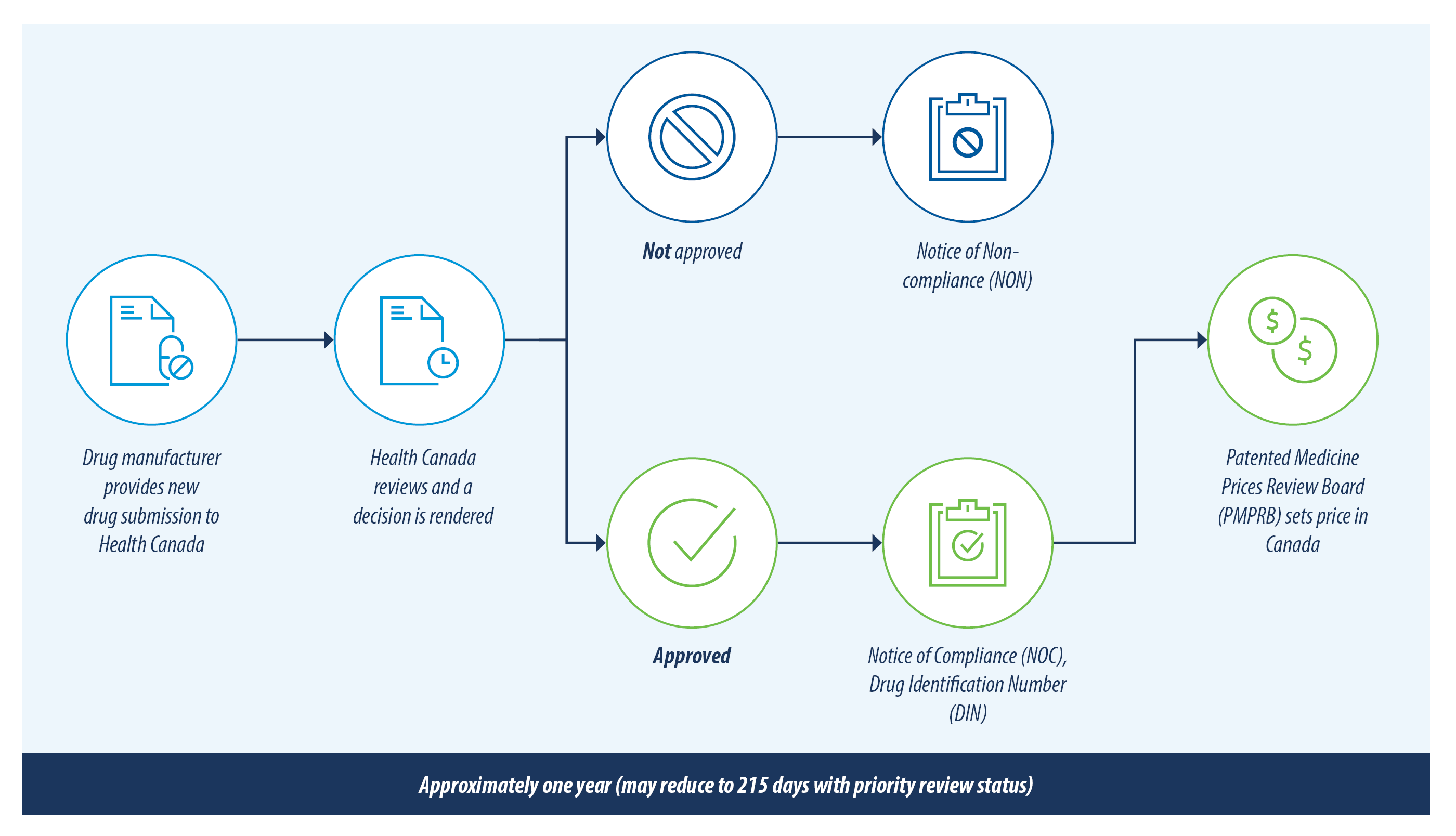

The figure below illustrates the review process for new drug products in Canada.

There are currently over 200 new drugs and generic drugs under review with Health Canada. This list has been reviewed and only the drugs most likely to have an impact on private drug plans are included in this report. A summary of the drugs included and excluded from this review is outlined below.

| Included | Excluded |

|---|---|

|

|

The pricing of new drugs in Canada is subject to approval by the PMPRB and not known until the drug is marketed. Therefore, any prices provided on this webpage for drugs not yet marketed are meant as a reference point only as they reflect the list prices in other countries where the drug is available. Effective July 1, 2022, there were amendments to the regulations that PMPRB follows. These amendments saw a new basket of comparator countries to determine the approved Canadian pricing, now notably excluding the United States. As most of these drug prices are the list price in the United States, the Canadian list price, once marketed, will most likely be lower than the referenced United States price provided on this webpage.

Notable drugs

Migraine

| Drug name | Medicinal ingredient | Indication | Health Canada status | Estimated pricing |

|---|---|---|---|---|

| Qulipta | Atogepant | Prevention of migraine | Approved December 2022; not yet marketed | $12,057 USD per year1 |

Qulipta

In 2018, a new class of medication targeting the protein that causes migraines, calcitonin gene-related peptide (CGRP), quickly cemented its position in the management of this prevalent condition. To date, CGRP antagonists are administered by injection and soon, Canadians may be able to take this class of medication orally once Qulipta is available. The recently approved submission is for the prevention of episodic migraines. However, to compete with the injectable drugs of the same therapeutic class (for example, Aimovig, Emgality, Ajovy and Vyepti), the drug manufacturer will need to submit for the prevention of chronic migraine as well.

Canadian pricing of Qulipta has not been determined yet but it will be competing with other injectable migraine prevention medications (Aimovig, Emgality and Ajovy, which can cost from $6,400 to $7,500 annually) and with the newest injectable CGRP antagonist (Vyepti, which depending on dosing can range from $10,125 to $30,375 annually).

Weight loss and diabetes

| Drug name | Medicinal ingredient | Indication | Health Canada status | Estimated pricing |

|---|---|---|---|---|

| Wegovy | Semaglutide | Weight loss | Approved November 2021; not yet marketed | $4,726 CAD per year2 |

| Mounjaro | Tirzepatide | Diabetes | Approved November 2022; not yet marketed | $12,666 USD per year3 |

Wegovy

Obesity is designated as a chronic disease by WHO and is a major risk factor for other serious conditions including type 2 diabetes, cardiovascular disease, hypertension, stroke and certain forms of cancer. Existing approved therapies in Canada cost around $2,000 to $4,100 annually, with glucagon-like peptide 1 (GLP-1) agonists as the most utilized type of therapy. This class of medication has been successful in managing diabetes at lower doses and results in weight loss at higher doses. Liraglutide, a once-daily GLP-1 agonist injection, at a lower dose is marketed as Victoza, for the management of diabetes, and Saxenda, for the management of obesity, at a higher dose. The manufacturer of Ozempic (semaglutide), a drug used for diabetes has used this same marketing approach and rebranded the higher dose semaglutide product as Wegovy to compete in the anti-obesity drug category. Clinical trials so far have shown Wegovy to be superior to other weight loss medications on the market.

Mounjaro

Diabetes is a top treated health condition on any drug plan and is only expected to impact drug plans further with its increasing prevalence. Ozempic, a GLP-1 agonist, experienced tremendous success since its arrival on the Canadian drug market and is now a mainstay in managing type 2 diabetes—propelling it to the top diabetic drug by spend on 2021 Alberta Blue Cross’s® private drug plans. Mounjaro, a newly approved medication, works as a GLP-1 agonist as well, but is the first diabetic medication to also activate the receptor for another hormone, gastric inhibitory polypeptide (GIP), to further regulate blood sugar levels. In one of its clinical trials, 50 per cent of Mounjaro patients in the early stages of diabetes went into remission. With these promising results, remission of type 2 diabetes is being discussed as the potential new goal of diabetes management, a result that no other diabetes medication has achieved. In addition, clinical trials comparing Mounjaro against Ozempic has shown that Mounjaro is more effective in lowering A1C levels, a marker indicating how well diabetes is managed. In the United States, Mounjaro has the same annual cost, $12,666 USD, at any strength. Its Canadian pricing is not yet available but it would be competing with Ozempic which has a price range of $2,600 to $5,300 annually.

In clinical trials, Mounjaro with its dual GIP/GLP-1 receptor agonist action, also demonstrated its strong potential as a weight loss medication. Based on this, the manufacturer will likely submit for approval as a weight loss drug in the future.

Cardiovascular

| Drug name | Medicinal ingredient | Indication | Health Canada status | Estimated pricing |

|---|---|---|---|---|

| Verquvo | Vericiguat | Heart failure | Under review; submitted January 2021 | $7,100 USD per year4 |

| Camzyos | Mavacamten | Hypertrophic cardiomyopathy (HCM) | Approved November 2022; not yet marketed | $89,500 USD per year5 |

Verquovo

Heart failure is the third most common reason for hospitalization in Canada. It is often referred to as a “revolving door” condition because 1 in 5 heart failure patients will need to be readmitted to the hospital within a month of being discharged. Verquvo is the first chronic heart failure drug to be indicated specifically for patients who recently received intravenous treatment, usually while hospitalized, due to worsening heart failure symptoms. In clinical trials, Verquvo, an add-on oral therapy, has shown to reduce deaths and hospital admissions due to heart failure symptoms. The annual cost of Verquvo in the United States is approximately $7,100 USD.

Camzyos

Heart disease is most recognized as a chronic condition with modifiable risk factors; however, approximately 1 in 500 people are affected by a genetically inherited heart disease called hypertrophic cardiomyopathy (HCM). Many cases of HCM, the most common genetic heart disease, are asymptomatic but some can have symptoms as serious as sudden death. Existing treatments such as beta blockers only treat symptoms of the chronic condition; Camzyos is the first drug to treat the underlying disease. The annual cost for Camzyos is $89,500 USD in the United States.

Plaque psoriasis

| Drug name | Medicinal ingredient | Indication | Health Canada status | Estimated pricing |

|---|---|---|---|---|

| Bimzelx | Bimekizumab | Plaque psoriasis | Marketed March 2022 | From $22,800 to $42,300 CAD (weight based) per year6 |

| Sotyktu | Deucravacitinib | Plaque psoriasis | Approved November 2022; not yet marketed | $75,000 USD per year7 |

Bimzelx

Plaque psoriasis can already be treated by select biologics available on the Canadian drug market, however, a new biologic, Bimzelx, was approved in February 2022. Bimzelx touts improved skin clearance when compared with 3 other commonly used biologics for psoriasis. Adalimumab, ustekinumab and secukinumab range in annual cost from $12,250 (adalimumab) to $31,300 (usetekinumab maximum dose). Bimzelx is dosed according to patient weight and costs between $21,125 and $42,240 annually.

Sotyktu

Soyktu is a new oral class of medication that is an improvement on JAK inhibitors, a medication class that is used to treat inflammatory conditions. Although JAK inhibitors are approved in Canada for many inflammatory conditions such as rheumatoid arthritis and ulcerative colitis, none of the JAK inhibitors are approved in Canada for treatment of plaque psoriasis. In the United States, drugs in this medication class have been approved for treatment of plaque psoriasis. Soyktu belongs to a new class of medication that is more selective than JAK inhibitors, potentially avoiding the risk of significant adverse events like heart attacks and strokes due to blood clots. These adverse events have resulted in black box warnings for JAK inhibitors Xeljanz, Olumiant and Rinvoq in the United States. Soyktu is set to compete against first-in-class oral drug, Otezla, which costs approximately $13,800 annually.

Macular degeneration

| Drug name | Medicinal ingredient | Indication | Health Canada status | Estimated pricing |

|---|---|---|---|---|

| Vabysmo | Faricimab | Age-related macular degeneration (AMD) and diabetic macular edema (DME) | Marketed July 2022 | From $4,374 to $20,412 CAD per year8 |

| Susvimo (Ranibizumab Port Delivery System) | Ranibizumab | Age-related macular degeneration (AMD) | Approved September 2022; not yet marketed | $17,250 USD for the 1st year; each subsequent year costs $16,000 USD9 |

Vabysmo and Susvimo

Age-related macular degeneration (AMD) and diabetic macular edema (DME) rank as the top 2 causes of vision loss in adults. Eylea and Lucentis are the current standard of care and are administered through monthly eye injections. Susvimo is a port delivery system that administers the same active ingredient as Lucentis, ranibizumab. Susvimo is a one-time surgical implant which delivers ranibizumab continuously and only needs to be refilled every 6 months.

Vabysmo has a more flexible dosing regimen than the existing therapies for AMD and DME. Depending on the patient’s vision outcomes and anatomy, Vabysmo has the potential for less frequent dosing than current therapies, making it a more convenient and less costly alternative.

Eylea and Lucentis are currently funded by the Government of Alberta if criteria are met. Given this, there is potential that Vabysmo and Susvimo may also be government-funded in the future.

Rare disease drugs

Rare diseases impact a small portion of the population and are often life threatening or debilitating. Generally, rare diseases have a poor prognosis with no or limited treatment options available. Technological advancements and investments into complex research and development for certain rare diseases have yielded effective life-changing therapies, giving patients and their loved ones hope. Because of this progress, drug manufacturers have continued investing in these areas and Canadian drug approvals for rare diseases have grown exponentially. In the past 2 decades, research and development of rare disease drugs has grown exponentially. In 2021 alone, there were over 350 drugs in phase 3 clinical trials, the last phase before submission for drug approval. As there are still many rare diseases without effective treatment options, we expect this growth to continue.

Rare disease drugs submitted to Health Canada this year have annual costs up to $1.7 million CAD. Luxturna, the last drug in the table below, is a gene replacement therapy introduced in last year’s drug pipeline report. It is now marketed in Canada and costs $1,031,500 ($515,750 per eye) for a one-time therapy for patients with vision loss due to inherited retinal disease.

Historically, the majority of rare disease drugs were covered by government funding. However, given the growth in this drug category and the associated ultra high price tags, government funding may not be reliable or consistent in the future. Alberta Blue Cross® watches these drugs closely for alternate funding or inclusion in government programs. In addition, given the increasing availability of rare disease drugs and their substantial costs, plan sponsors should conduct a thorough review of drug benefit plan designs and financial management mechanisms to ensure that plan sustainability is maintained. Alberta Blue Cross® would be pleased to assist with this review.

| Drug name | Medicinal ingredient | Indication | Health Canada status | Estimated pricing |

|---|---|---|---|---|

| Oxlumo | Lumasiran | Primary Hyperoxaluria Type 1 (PH1) | Marketed May 2022 | From $387,421 to $1,743,395 CAD per year10 |

| Palynziq | Pegvaliase | Phenylketonuria (PKU) | Marketed August 2022 | From $130,205 to $443,475 CAD per year11 |

| Albrioza | Sodium phenylbutyrate, ursodoxicoltaurine | Amyotrophic Lateral Sclerosis (ALS) | Marketed July 2022 | From $217,459 to $223,900 CAD per year12 |

| Sohonos | Palovarotene | Fibrodysplasia ossificans progressiva (FOP) | Marketed June 2022 | Pricing unavailable |

| Rezurock | Belumosudil mesylate | Chronic graft-versus-host disease (chronic GVHD) | Approved October 2022; not yet marketed | Estimated $188,000 USD per year13 |

| Orladeyo | Berotralstathydro- chloride |

Prophylaxis of hereditary angioedema (HAE) | Marketed September 2022 | $310,463 CAD per year14 |

| Luxturna Gene therapy |

Voretigene | Inherited Retinal Disease (IRD) | Marketed March 2022 | $1,031,500 CAD per one-time treatment (both eyes)15 |

Biosimilars

Many emerging public payer biosimilar policies are driving prescribing decisions and as a result, there is an increase in the uptake of biosimilar drugs leading to savings for patients and drug benefit plans.

Health Canada-approved biosimilars for Humira, Enbrel and Remicade have been marketed for a few years, yet additional biosimilar versions of these biologics are still coming to the Canadian drug market. Simlandi and Yuflyma are the first adalimumab biosimilars for the high concentration formulation (100mg/mL), the most commonly used formulation in the United States.

Byooviz has become the first Lucentis biosimilar, a biologic used to treat retinal vascular disorders, including AMD, one of the leading causes of blindness in Canada. Funding for Lucentis is available through provincial government funding in Alberta if criteria are met, and likely will apply to Byooviz as well.

Additional insulin biosimilars have recently been approved for NovoRapid and Lantus insulins. In the drug pipeline, a Lantus biosimilar is pioneering legislation changes to biosimilar insulin products in the United States. Semglee was recently approved by the United States Food and Drug Administration (FDA) as an interchangeable biosimilar, allowing pharmacists to substitute Lantus for Semglee without intervention of the prescriber. In Canada, however, interchangeability decisions rest with provincial or territorial governments. At this time, no biosimilars are deemed interchangeable with their innovator biologic anywhere in Canada; this requires a patient to get a new prescription when switching between biologic products.

| Biosimilars' Status | ||||

|---|---|---|---|---|

| Innovator biologic | Therapeutic use | Under Health Canada review | Approved (not yet marketed) | Recently marketed |

| Humira | Numerous autoimmune disorders such as rheumatoid arthritis and inflammatory bowel disease |

|

||

| Enbrel | Numerous autoimmune disorders such as rheumatoid arthritis and inflammatory bowel disease |

|

||

| Remicade | Numerous autoimmune disorders such as rheumatoid arthritis and inflammatory bowel disease |

|

||

| NovoRapid | Diabetes |

|

||

| Lantus | Diabetes |

|

||

| Lucentis | Retinal vascular disorders such as age-related macular degeneration and diabetic macular edema |

|

First-entry generic drugs

Generic drugs enter the market after patent and data protection of the brand name drug ends via expiry or litigation. First-entry generic drugs, which are generic products for brand name drugs that previously did not have generic options available, impact private drug plans most when they become available for commonly utilized or high-cost therapies.

In Canada, the pan-Canadian Pharmaceutical Alliance (pCPA) framework dictates the pricing of new generic products resulting in substantial savings. For example, because of the framework, if a generic oral pill is approved in Canada, there are at least 15 per cent in savings in comparison to the brand name product when it is the first and only generic available. These savings can increase to 75 per cent once there are 3 or more generic products on the Canadian market. Currently, the pCPA generic framework is under review as the current framework for pricing expires in April 2023.

The 2 health conditions which have notable firstentry generics coming to the Canadian drug market are diabetes and ADHD. These 2 health conditions have been growing year over year in utilization and spend, and were in the top 5 health conditions of Alberta Blue Cross® private plans in 2021. Vyvanse is the top ADHD medication on our plans and it is often found on many private drug plans’ top 10 drugs; the introduction of a generic will yield savings for those plans with a generic pricing policy in place. Similarly, generic products for diabetic drugs will help mitigate the growth of diabetic spend which was the most expensive health condition of Alberta Blue Cross® private drug plans in 2021.

| Generics' Status | |||||

|---|---|---|---|---|---|

| Brand name drug | Therapeutic use | Number of generic products | Under Health Canada review | Approved (not yet marketed) | Marketed |

| Dymista | Seasonal allergic rhinitis | 2 |

|

||

| Forxiga | Diabetes | 11 |

|

||

| Intuniv XR | ADHD | 4 |

(2)

|

(2)

|

|

| Invokana | Diabetes | 2 |

|

||

| Jardiance | Diabetes | 6 |

|

||

| Jentadueto | Diabetes | 1 |

|

||

| Jublia | Topical anti-fungal | 9 |

|

||

| Synjardy | Diabetes | 1 |

|

||

| Trajenta | Diabetes | 5 |

|

||

| Trintellix | Depression | 3 |

|

||

| Victoza | Diabetes | 1 |

|

||

| Vyvanse | ADHD | 5 |

|

||

| Xigduo | Diabetes | 2 |

|

Alberta Blue Cross® drug management strategy

Drug plan management at Alberta Blue Cross® starts with a solid unique foundation built on systems and management processes that all our drug plans benefit from. In addition, we offer numerous optional plan management features that mitigate rising drug costs and ensure plan sustainability.

Foundational drug plan management

| Management strategy | Description |

|---|---|

| Comprehensive drug review process | New drugs are thoroughly reviewed by our in-house pharmacists and drug review committee who critically assess the scientific, therapeutic and economic value of each drug before a listing decision is rendered. |

| Drug price management | We have extensive management of drug prices to ensure our files reflect the current drug price landscape across Canada. |

| Product listing agreements | On behalf of plan sponsors, we negotiate product listing agreements with drug manufacturers for various drugs to maintain drug plan affordability and sustainability. |

| Opioid management |

We promote proactive narcotic management based on current guidelines and best practice prescribing through use of the following:

|

| Responsive management strategies | We continue to monitor the drug environment as utilization and government policies evolve and will continue to adapt our listing strategies to ensure continued optimal management and savings for our drug plans. |

Optional drug plan management strategies

| Management strategy | Description |

|---|---|

| Managed formulary | This formulary includes special authorization and step therapy as standard strategies. Our managed formulary protects plan sponsors as the market for high-cost therapies continues to expand. |

| Special authorization | A standard feature on our managed formulary that is applied to high-cost drugs where there is opportunity to ensure those therapies are covered only for members meeting clinical criteria. Additionally, special authorization ensures members are accessing any publicly-funded drug programs first before coverage is granted on their private plan. |

| Step therapy | Another standard feature on our managed formulary used to manage lower-cost traditional drugs. It is a clinical management feature that requires the use of 1 or more “first-line” drugs before a “secondline” drug is approved for coverage through the automated real-time claims adjudication system. |

| Biologic strategy | We are continually evaluating our biologic and biosimilar listing strategies to ensure they are most advantageous for members and plan sponsors. With our managed formulary we are not limited to using just one strategy. We currently use a biosimilar first strategy for some biologics and maintain member or prescriber choice for others by using manufacturer agreements to ensure costs of the innovator biologic and biosimilar are comparable. |

Other strategies for traditional drugs

|

We have several management strategies available for lower-cost traditional drugs. The savings realized from these management strategies ensure plan sponsors can continue to offer access to higher-cost therapies while keeping their drug plan sustainable. |

What's next

Alberta Blue Cross® continues to closely monitor the growing pipeline of new medicines while assessing the impact on drug benefit plans. We are committed to helping our customers navigate the drug landscape while always prioritizing the health of plan members and the sustainability of drug plans.

Cost listing references

[3] https://www.lillypricinginfo.com/mounjaro

[4] https://www.merckconnect.com/static/pdf/Colorado-Pricing-Sheets-VERQUVO-vericiguat.pdf

[5] https://www.biopharmadive.com/news/bristol-myers-fda-approval-heart-drug-camzyos-myokardia/622732/

[6] Canadian list price

[7] https://www.biopharmadive.com/news/bristol-myers-tyk2-fda-approval-sotyktu-psoriasis/631577/

[8] Canadian list price

[10] Canadian list price

[11] Canadian list price

[12] Canadian list price

[14] Canadian list price

[15] Canadian list price

Questions?

To learn how the benefit plan management team can help your organization, contact your Alberta Blue Cross® representative today.