Drug pipeline

Download PDF versionWhat lies ahead and considerations for employer benefit plans

Contents

Executive summary

Research and innovation for new drug therapies is continually evolving and advancing. In recent years, the majority of new medicines coming to market are high-cost specialty drugs, which puts pressure on private drug plans as costs continue to rise from year to year. This document highlights some of the notable developments within the Canadian drug pipeline to provide plan sponsors with insight into what’s to come for their members and their drug plans.

Drug pipeline at a glance

Cardiovascular drugs

Drugs for the treatment of cardiovascular disease are commonly used by plan members. The most common oral therapies used in this therapeutic area cost an average of $200 annually. Biologic therapies for the treatment of high cholesterol were introduced a few years ago (Repatha and Praluent) and come with higher annual costs of over $6,000. While uptake of these biologic drugs to date has been low, we are seeing several new therapies entering the market with annual costs ranging from $2,600 to more than $6,000.

Migraine prevention

New biologic therapies for migraine prevention emerged in Canada in late 2018, with three biologics currently available having costs ranging from $6,400 to $7,500 annually. This category continues to expand as a fourth biologic therapy was recently approved by Health Canada, though market launch has not yet occurred.

Multiple sclerosis

New therapies for treatment of this autoimmune disorder continue to emerge, with several drugs currently under review or recently approved in Canada. These drugs are often high-cost therapies with annual prices more than $10,000.

Rare disease drugs

Developments in drugs used to treat rare diseases continues to grow, with several drug therapies currently under review or recently approved in Canada. Some of these therapies fall under a new and innovative treatment class known as gene therapy, which can offer a potential cure for previously intractable diseases with just a single dose. While rare disease drugs offer new and important therapy options for patients afflicted by these conditions, they have high drug costs associated that often exceed $100,000 annually or, for gene therapy, over $1 million for a single dose. Federal funding for rare disease drugs is under development; however, the scope of this program and the drugs to be included is still to be determined.

Generics and biosimilars

The emergence of new generic and biosimilar drugs offer treatment options at a reduced list price compared to their brand name and innovator biologic counterparts. There are several notable first-entry generics (such as generic products for brand name drugs that previously did not have generic options available) coming to market, including those for high cost oral therapies used in inflammatory conditions or multiple sclerosis. The most notable biosimilars recently marketed are for Humira, which is a high-cost drug commonly utilized for various autoimmune disorders.

Medical cannabis

Research into the therapeutic use of cannabis for various medical conditions is currently underway, with multiple cannabis-based products being developed. However, these new cannabis-based products have not yet been submitted to Health Canada for consideration as a drug product (that is a drug with a drug identification number). Cannabis continues to be available in Canada for both medicinal and recreational purposes.

Background

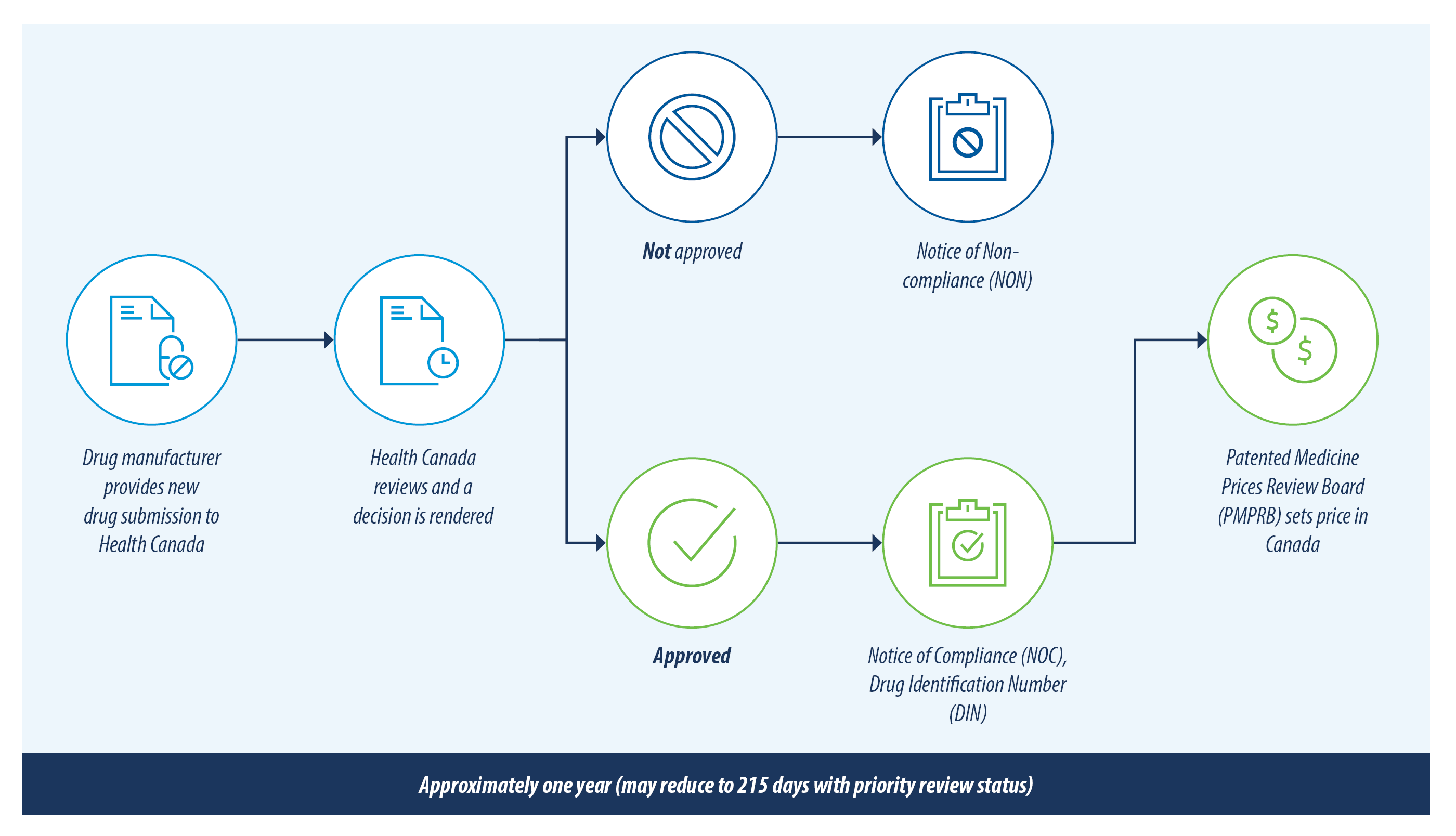

The figure below illustrates the review process for new drug products in Canada.

There are currently over 200 new drugs and generic drugs under review with Health Canada. This list has been reviewed and only the drugs most likely to have an impact on private drug plans are included in this report. A summary of the drugs included and excluded from this review is outlined below.

| INCLUDED | EXCLUDED |

|---|---|

|

|

The pricing of new drugs in Canada are subject to approval by the PMPRB and are not known until the drug is marketed. Therefore, any prices provided in this document for drugs not yet marketed, or with Canadian list prices not yet publicly available, are meant as a reference point only as they reflect the list prices in other countries where the drug is available.

Notable drugs

Cardiovascular

Innovation for drugs used in the treatment of cardiovascular disease has remained relatively stagnant over the years, with few new therapies entering the market. The most recent developments in this area were the introduction of biologic therapies used in the treatment of high cholesterol (Repatha and Praluent). These biologics have annual costs of over $6,000 annually; however, their utilization to date has been low. In comparison, common oral therapies for the treatment of cardiovascular disease have an average annual cost of $200. This past year has seen the emergence of several new therapies, which are under review with Health Canada or recently marketed and are outlined in the table below.

| Drug Name | Medical Ingredient | Indication | Health Canada status | Estimated Pricing |

|---|---|---|---|---|

| Vascepa | Icosapent ethyl | Reduce risk of ischemic cardiovascular events | Marketed February 2020 | $3,600 CAD per year1 |

| Leqvio | Inclisiran | Hypercholesterolemia | Approved July 2021, not yet marketed | $3,600 to $6,000 USD per year2 |

| Corzyna | Ranolazine | Add-on therapy for stable angina pectoris | Marketed May 2021 | $2,600 to $5,100 CAD per year1 |

Vascepa

Vascepa (icosapent ethyl) is indicated in combination with statin therapies to reduce the risk of cardiovascular events such as heart attack and stroke. Vascepa offers a new treatment option for patients with the active ingredient being a purified synthetic derivative of omega-3. Vascepa was marketed in Canada in February 2020 after undergoing priority review with Health Canada. While current add-on therapies to statin treatments are less than $1,000 annually, the cost of Vascepa is $3,600 per year.

Leqvio

Leqvio (inclisiran) is used in treatment of hypercholesterolemia (high cholesterol). It uses a unique mechanism of action by targeting ribonucleic acid (RNA) to reduce Low-Density Lipoproteins (LDL), which is the “bad” cholesterol in the blood. While the most common therapies for treating high cholesterol are daily oral tablets, newer agents such as Repatha and Praluent have become available in recent years. These new agents are administered through injections on a two-week or monthly schedule. Leqvio is also administered through injection, though it offers a reduced administration of only twice annually. Leqvio was recently approved in Canada in July 2021 but has not yet been marketed. Information regarding the estimated annual cost of Leqvio is not yet available; however, it is expected to be priced between $3,600 to $6,000 USD annually.

Corzyna

Corzyna (ranolazine) was approved by Health Canada in December 2020 after undergoing a priority review and just recently entered the market in May 2021 with a cost ranging from $2,600 to $5,100 annually. Corzyna is an add-on treatment for patients with stable angina pectoria (chest pain). While this drug is a new therapeutic class for angina in Canada, it has been available in the United States under the name of Ranexa for over a decade.

Migraine

Preventative therapies for migraine headaches was historically limited to oral therapies (many used off-label from their approved indications) and Botox injections. However, a new class of therapeutic options, known as CGRP inhibitors, emerged in late 2018 using a novel mechanism of action and are the first biologic drug options for migraine prevention. This new class of therapies has rapidly expanded over the past two years with three biologic therapies now available in Canada that have annual list prices ranging from $6,400 to $7,500 annually. The newest therapy for migraine prevention is outlined below.

| Drug Name | Medical Ingredient | Indication | Health Canada status | Estimated Pricing |

|---|---|---|---|---|

| Vyepti | Eptinezumab | Prevention of migraines | Approved January 2021, not yet marketed | $5,980 USD per year3 |

Vyepti

Vyepti (eptinezumab) will become the newest CGRP inhibitor to become available in Canada for the prevention of migraine headaches. Current therapies approved in Canada include Aimovig, Emgality and Ajovy. All are administered through subcutaneous injection. Vypeti offers a unique administration compared to the other CGRP inhibitors available as it is provided through intravenous (IV) infusion four times a year and is touted to take effect as quickly as the next day after infusion. The annual cost of Vyepti in the United States is $5,980 USD.

Multiple sclerosis

There are many therapies available in Canada to treat multiple sclerosis, a chronic autoimmune disease. These therapies include both oral and injectable options and have treatment costs ranging from $12,000 to more than $32,000 annually. Recently, lower-cost generic alternatives have started to become available for oral multiple sclerosis treatments.

Gilenya’s generic was launched in late 2019 and Tecfidera’s generic is anticipated later this year. While plan sponsors may benefit from these lower-cost generic multiple sclerosis drugs, new therapies for multiple sclerosis continue to be developed and often with high price tags associated. New therapies can offer advantages over previous therapies, such as improved efficacy or side effect profiles, which may lead to patients switching to these drugs as they become available. There are several new multiple sclerosis therapies emerging on the Canadian market and are outlined in the table below.

| Drug Name | Medical Ingredient | Indication | Health Canada status | Estimated Pricing |

|---|---|---|---|---|

| Vumerity | Diroximel fumarate | Relapsing forms of multiple sclerosis including CIS, RRMS and SPMS | Under review since July 2020 | $88,000 USD per year4 |

| Kesimpta | Ofatumumab | RRMS | Marketed April 2021 | $28,000 CAD per year1 |

| Ponvory | Ponesimod | Relapsing forms of multiple sclerosis including CIS, RRMS and SPMS | Approved April 2021, not yet marketed | Not yet known (anticipated to be similar to current therapies priced between $25,000 and $32,000 CAD annually)5 |

CIS = Clinically Isolated Syndrome, RRMS = Relapse-Remitting Multiple Sclerosis, SPMS = Secondary Progressive Multiple Sclerosis.

Rare disease drugs

Rare diseases are those that impact a small portion of the population, are often life threatening or debilitating and generally have no or limited treatment options available. Due to the low prevalence of these conditions and the complexities involved in research and development of drug therapies, rare disease drugs are accompanied by high price tags, usually in excess of $100,000 annually.

To assist Canadians in accessing the rare disease drugs they need, the federal government announced in Budget 2019 that a national strategy for rare disease drugs would be developed and $500 million per year would be allocated to funding rare disease drugs starting in 2022 or 2023.

While it is still unclear how the national rare disease strategy will be implemented or which rare disease drugs will be covered, the pipeline for rare disease therapies in Canada continues to grow and expand. Some of these therapies fall under a new and innovative treatment class known as gene therapy, which involves the introduction of genetic material into a patient to correct a problem caused by faulty or missing genes. Gene therapies are particularly promising as they offer a potential cure for previously intractable diseases with just a single dose. The Alberta and Ontario governments have authorized interim access to Zolgensma (a gene therapy used in children with spinal muscular atrophy) and will consider funding on a case-by-case basis.

The table below outlines some of the rare disease drugs recently approved or marketed in Canada, including some gene therapies. Alberta Blue Cross® watches these drugs closely for alternate funding or inclusion in government programs to protect plan sponsors should a member require one of these high-cost therapies.

| Drug Name | Medical Ingredient | Indication | Health Canada status | Estimated Pricing |

|---|---|---|---|---|

| Trikafta | Elexacaftor, ivacaftor, tezacaftor | Cystic fibrosis | Marketed June 2021 | $306,600 CAD per year6 |

| Tavalisse | Fostamatinib | Chronic immune thrombocytopenia | Marketed Dec 2020 | $59,000 to $88,600 CAD per year1 |

| Reblozyl | Luspatercept | Anemia in beta thalassemia | Marketed Nov 2020 | $113,828 - $151,711 per year (based on dosage)7 |

| Zolgensma *Gene Therapy | Onasemnogene | Spinal muscular atrophy | Marketed Feb 2021 | $2.9 million CAD for a single dose1 |

| Evrysdi | Risdiplam | Spinal muscular atrophy | Marketed May 2021 | $93,000 to $354,000 CAD per year (based on patient weight)1 |

| Dojolvi | Triheptanoin | Long Chain Fatty Acid Oxidation Disorders (LC-FAOD) | Marketed April 2021 | $85,000 to $302,000 CAD per year (based on required daily caloric intake)1 |

| Luxturna *Gene Therapy | Voretigene | Inherited Retinal Disease (IRD) | Approved Oct 2020, not yet marketed | $515,750 CAD per eye8 |

First-entry generic drugs

Generic drugs enter the market after patent and data protection of the brand name drug ends via expiry or litigation and are priced at 25 to 85 per cent of the cost of the brand name drug. First-entry generic drugs, which are generic products for brand name drugs that previously did not have generic options available, impact private drug plans most when they become available for commonly utilized or high-cost therapies.

Diabetes, cardiovascular disease (including high blood pressure) and asthma or chronic obstructive pulmonary disease are within the top conditions for private plans by drug spend. Additional generic options in these therapeutic areas provides plan members with cost-effective alternatives, which can reduce drug plan costs.

Aubagio, Tecfidera, Otezla and Xeljanz have high annual costs, generally over $15,000 annually. While these therapies are used to treat less common conditions, having a generic option for high-cost drugs can have a significant impact on costs for the member as well as the private plan.

The table below outlines notable first-entry generic drugs that are currently under review, approved or recently marketed by Health Canada.

| Generics' Status | ||||

|---|---|---|---|---|

| Brand name drug | Therapeutic use | Under Health Canada review | Approved (not yet marketed) | Marketed |

| Invega (oral) | Antipsychotic |

|

||

| Invega Sustenna (inj) | Antipsychotic |

|

||

| Latuda | Antipsychotic |

|

||

| Flovent HFA | Asthma/COPD |

|

||

| Bystolic | Blood pressure |

|

|

|

| Brilinta | Blood thinner |

|

|

|

| Eliquis | Blood thinner |

|

||

| Xarelto | Blood thinner |

|

|

|

| Invokana | Diabetes |

|

||

| Janumet | Diabetes |

|

||

| Januvia | Diabetes |

|

||

| Onglyza | Diabetes |

|

||

| Trajenta | Diabetes |

|

||

| Jinarc | Diuretic |

|

||

| Aubagio | Multiple sclerosis |

|

||

| Tecfidera | Multiple sclerosis |

|

||

| Toviaz | Multiple sclerosis |

|

|

|

| Otezla | Psoriasis, PsA, Behçet’s |

|

||

| Xeljanz | RA, PsA, UC |

|

Biosimilars

Biologics are injectable drugs that are large, complicated molecules manufactured in living cells and are used to treat a variety of medical conditions. Biosimilars are biologic drugs that have entered the market after an innovator biologic (that is, the first biologic to market) and have demonstrated similarity to the innovator biologic at a reduced cost. Biosimilars currently marketed in Canada are priced at 51 to 82 per cent of the cost of the innovator biologic.

The most notable biosimilars recently marketed in Canada are for the innovator biologic Humira; there is substantial competition with six biosimilars approved by Health Canada already. This biologic is used for several autoimmune disorders and in 2020, ranked second in the top drugs by spend on the Alberta Blue Cross® book of business.

A summary of the notable biosimilars currently under review with Health Canada or recently approved and marketed are outlined below.

| Biosimilars' Status | ||||

|---|---|---|---|---|

| Innovator Biologic | Therapeutic use | Under Health Canada review | Approved (not yet marketed) | Marketed |

| Humira | Numerous autoimmune disorders such as rheumatoid arthritis and inflammatory bowel disease |

|

|

|

| Lovenox | Blood thinner |

|

||

| NovoRapid | Diabetes |

|

|

Medical cannabis update

Health Canada has not issued a notice of compliance for medical cannabis; therefore, it does not currently have a DIN. Clinical trials are underway across Canada and in other countries to study the therapeutic effects of cannabis on various medical conditions. Evidence generated from these trials will be used to support and inform the development of cannabis-based drug products, which must demonstrate safety and efficacy to seek approval from Health Canada for a DIN. While there are several cannabis-based drug products under development, no products have been submitted to Health Canada for review as a drug product yet.

Cannabis is available in Canada through licensed producers when purchased for medical purposes and through provincial and territorial retailers when purchased for recreational use. Dosage forms available for cannabis are outlined in the table below and are available for either recreational or medical purposes.

| Dosage forms | New dosage forms added in October 2019 |

|---|---|

|

|

Alberta Blue Cross® drug management strategy

Drug plan management at Alberta Blue Cross® starts with a solid unique foundation built on systems and management processes that all our drug plans benefit from. In addition, we offer numerous optional plan management features that mitigate rising drug costs and ensure plan sustainability.

FOUNDATIONAL DRUG PLAN MANAGMENT

| Management strategy | Description |

|---|---|

| Comprehensive drug review process | New drugs are thoroughly reviewed by our in-house pharmacists and drug review committee who critically assess the scientific, therapeutic and economic value of each drug before a listing decision is rendered. |

| Drug price management | We have extensive management of drug prices to ensure optimal savings for our plans. |

| Responsive management strategies | We continue to monitor the drug environment as utilization and government policies evolve and will continue to adapt our listing strategies to ensure continued optimal management and savings for our drug plans. |

OPTIONAL DRUG PLAN MANAGEMENT STRATEGIES

| Management strategy | Description |

|---|---|

| Managed formulary | This formulary includes special authorization and step therapy as standard strategies. Our managed formulary protects plan sponsors as the market for high-cost therapies continues to expand. |

| Special authorization | A standard feature on our managed formulary and is applied to high-cost drugs where there is opportunity to ensure those therapies are covered only for members meeting clinical criteria. Additionally, special authorization ensures members are accessing any publicly-funded drug programs first before coverage is granted on their private plan. |

| Step therapy | Another standard feature on our managed formulary used to manage lower cost traditional drugs. It is a clinical management feature that requires the use of one or more ‘first-line’ drugs before a ‘second-line’ drug is approved for coverage through the automated real-time claims adjudication system. |

Other strategies for traditional drugs

|

We have several management strategies available for lower cost traditional drugs. The savings realized from these management strategies ensures plan sponsors can continue to offer access to higher-cost therapies while keeping their drug plan sustainable. |

What's Next

With the growing pipeline of innovative medications, Alberta Blue Cross® is here to help plan sponsors navigate the changing landscape of drug therapies and associated costs, always keeping the health of your members and the sustainability of your plan top of mind.

Cost listing references

[1] Canadian list price

[2] https://www.fiercepharma.com/special-report/inclisiran-10-most-anticipated-drug-launches-2021

[3] https://www.everydayhealth.com/migraine/fdagreenlights-vyepti-prevent-migraine-attacks/

[4] http://www.pmlive.com/pharma_news/biogen_under_fire_over_$88,000_vumerity_annual_price_1317387

Questions?

If you have any questions about this topic, please don’t hesitate to contact your Alberta Blue Cross® representative.